Smartklokker

Apple Watch

se nye tilbud

Vi flytter og

oppgraderer

lager og nettbutikk

Populære produkter

anbefalte

-

DEJI universal solcelle Powerbank 10.000mAh (37 Wh) med 2 USB-utganger. Lommelykt /blinkefunksjon

kr 350 inkl. MVAVi har testet ved å starte med solcelle-powerbanken helt tømt for strøm for å se om hvordan den fungerer i nødstilfelle. Etter relativt kort tid i solen var det nok til å starte lading av mobiltelefon. Man kan klare å holde telefonen ladet kontinuerlig uten tilgang til strømnettet dersom nødvendig, avhengig av mobilbruk, solforhold osv.

Praktisk på lange turer, i båt, på stranden osv. for lading av mobiltelefoner osv. Kraftig lommelykt med SOS-blinke-funksjon. Enkel i bruk (NB! husk bare et raskt trykk på POWER-knappen for å sette i gang lading – et lengre trykk vil skru på lykt!).

Universal solcelle Powerbank 10.000mAh (37Wh). -

Origami smartdeksel for Amazon Kindle Paperwhite5 (6.8-tommer)

kr 160 inkl. MVAVeldig lett (bare 102 gram) og fleksibel beskyttelse fra Walkers for Amazon 5. generasjon Paperwhite (11. gen) med 6,8″ skjerm. Fronten kan i tillegg til å åpnes som en bok og bøyes bak, også brettes på forskjellige måter for å fungere som et stativ både liggende og stående:

-

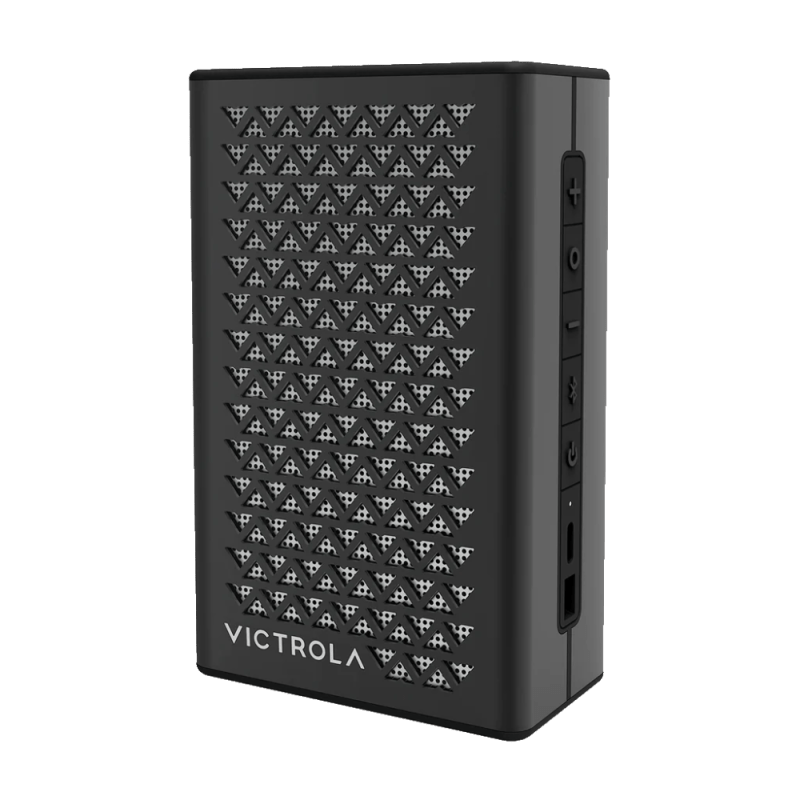

Victrola Wireless Music Edition 2 Tabletop Bluetooth Speaker m/innebygget trådløs ladeplate SØLV (alu.)

kr 1050 inkl. MVASolid og stilren metallutførelse. Kan brukes både ute og inne. Multi-speaker pairing tillater trådløs sammenkobling av to stykker. Legg mobilen på toppen for trådløs lading.

Les mer på produsentens side

Spesialtilbud

Apple iPhone

dager

timer

minutter

sekunder

Flere modeller

fra kr. ???,-

Siste produkter

...nylig lagt til i nettbutikken

-

Apple AirPods Pro Wireless In-ear (2019)

kr 1880 inkl. MVAAirPods Pro kom i 2019. Nye ubrukte, men ytre forpakning kan være byttet ut. Alt innvendig er urørt dvs. Airpods Pro, de hvite silikonproppene, ladekabel (USB-A NB! ta med lader hvis du trenger, se lenger ned, og selvsagt ladeetuiet), originalt og fabrikknytt.

-

Ring Video Doorbell 4 (Amazon Certified) ny, uten originaleske, Satin Nickel

kr 1180 inkl. MVAHar ikke vært i bruk, men kommer med alt tilbehør i grå nøytral eske.

Svar på ringeklokken uansett hvor du måtte befinne deg fra smarttelefonen. Kan kobles til eksisterende ringeklokke ledning og innvendig ringeklokke. Oppladabart batteri (kan også benyttes uten ledning).

-

Apple iPhone X

kr 2050 inkl. MVADu må velge blant tilgjengelige alternativer (på lager) for å få riktig pris og mulighet til å legge til handlekurven. NB! Se lenger ned for aktuelt tilbehør (brukte iPhone kommer uten tilbehør). Batteri-kapsitet 100%+* =BedreEnnNy kapasitet: Les mer her!

-

Amazon Echo Buds (2023) True Wireless Bluetooth 5.2 Earbuds with Alexa

kr 550 inkl. MVANB! Krever USB-C kabel til lading (ikke inkludert). Se ekstra tilbehør lenger ned.

All-new Echo Buds (2023 Release) | True Wireless Bluetooth 5.2 Earbuds with Alexa, audio personalization, multipoint, 20H battery with charging case, fast charging, sweat resistant.

-

Amazon Blink indoor Camera 3. gen. (batterier 2xAA inkludert)

kr 290 inkl. MVAKun kamera (NB! ikke med sync-modul som kan være nødvendig for en del funksjonalitet). Det følger med 2xAA lithium-batterier (holder inntil 2 år* dersom koblet trådløst til sync-modul). Kan evt. kobles til USB-lader (krever mikro-USB kabel). Kan benyttes sammen med sync-modul som ringeklokke. Har mikro-USB inngang (kabel følger ikke med og er heller ikke nødvendig). 1080p video. 110-grader diagonal synsvinkel. Kan plasseres stående på bord/hylle, men kan også monteres på vegg med medfølgende stativ.

-

Smartdeksel for Amazon Kindle 10 2019/20 Auto sleep/wake (for 6-tommer)

kr 150 inkl. MVALett smartdeksel i kunstig skinn fra Walkers for Amazon Kindle 10 (6″) 2019/20, som gir god beskyttelse til skjermen. Fronten kan åpnes som en bok og bøyes bak, og har innebygde magneter for smartfunksjon. Vekt: ca. 90gram. Kun for “Kindle Touch 2019 og 2020”. Passer ikke til tidligere generasjoner Kindle eller Kindle Paperwhite med 6.8″ skjerm. Enkel tilgang til alle funksjoner og kontroller. Slank, lett og hard deksel-design gir minimal tykkelse mens du beskytter ditt dyrebare lesebrett. Utvendig PU-lær både foran og bak og mikrofiberinteriør mot skjermen. Magnetisk lukking. Auto sleep/wake. Ingen rammer rundt skjermen muliggjør uhindret bevegelse.

-

Apple Amerikansk USB-nettlader/reiselader (uten USB-kabel) til lading av USB-produkter i land med US-kontakt (ev. Europa osv. med overgang)

kr 40 inkl. MVAModell: A1385. Original Apple iPhone lader til lading av USB-produkter i land med amerikansk kontakt, eller alle andre land i verden med riktig overgang. Reiselader som kan benyttes til de fleste produkter som lades via vanlig USB. Støtter både 110V og 220/240V. NB! Du trenger en USB kabel i tillegg (ikke inkludert), selges separat! -

Samsung Britisk USB-nettlader HVIT 2A (uten USB-kabel) til lading av alle USB-produkter i land med UK-kontakt

kr 40 inkl. MVAETA-U90UWE, HVIT, UT (USB-A): 2A, 5V (10W) INN: 230V. Original Samsung lader til lading av alle USB-produkter i land med UK-kontakt (også mange land i ASIA). Reiselader som kan benyttes til de fleste produkter som lades via vanlig USB i land hvor det er britisk stikkontakt. Støtter både 110V og 220/240V. NB! Du trenger en USB kabel i tillegg (ikke inkludert), selges separat!

Føl lyden

lydprodukter

-

Victrola Wireless Music Edition 2 Tabletop Bluetooth Speaker m/innebygget trådløs ladeplate SØLV (alu.)

kr 1050 inkl. MVASolid og stilren metallutførelse. Kan brukes både ute og inne. Multi-speaker pairing tillater trådløs sammenkobling av to stykker. Legg mobilen på toppen for trådløs lading.

Les mer på produsentens side

-

Victrola Wireless Music Edition 1 Bluetooth Speaker SVART

kr 350 inkl. MVAMå ha USB-C lader for å lade! (USB-C til USB-C kabel følger med). 12 timers batteritid. Metall-konstruksjon, Dual Speaker pairing, USB-C MP3 playback.

Les mer på produsentens side

Hvorfor ontel?

Nye og brukte iPhone og andre produkter

Flere nyheter kommer her snart.

Vi holder på å oppdatere nettbutikken med flere produkter og en bedre handleopplevese

Om ontel.no

Vi byttet navn til ONTEL i 2022, men har holdt på i mange år og med samme firma siden 2016 da det ble endret selskapsform, men nettbutikken er mye eldre, og vi satser på faste kunder gjennom mange år.

Nyheter

Du kan nå velge hentested for pakker, velge flere betalingsmetoder både privat og til firma, og mange andre nyheter (både produkter og funksjoner) etterhvert i den nye nettbutikken.

Meld deg på vårt nyhetsbrev

Få opptil ??% avslag på ditt kjøp