Smartklokker

Apple Watch

se nye tilbud

Vi flytter og

oppgraderer

lager og nettbutikk

Populære produkter

anbefalte

-

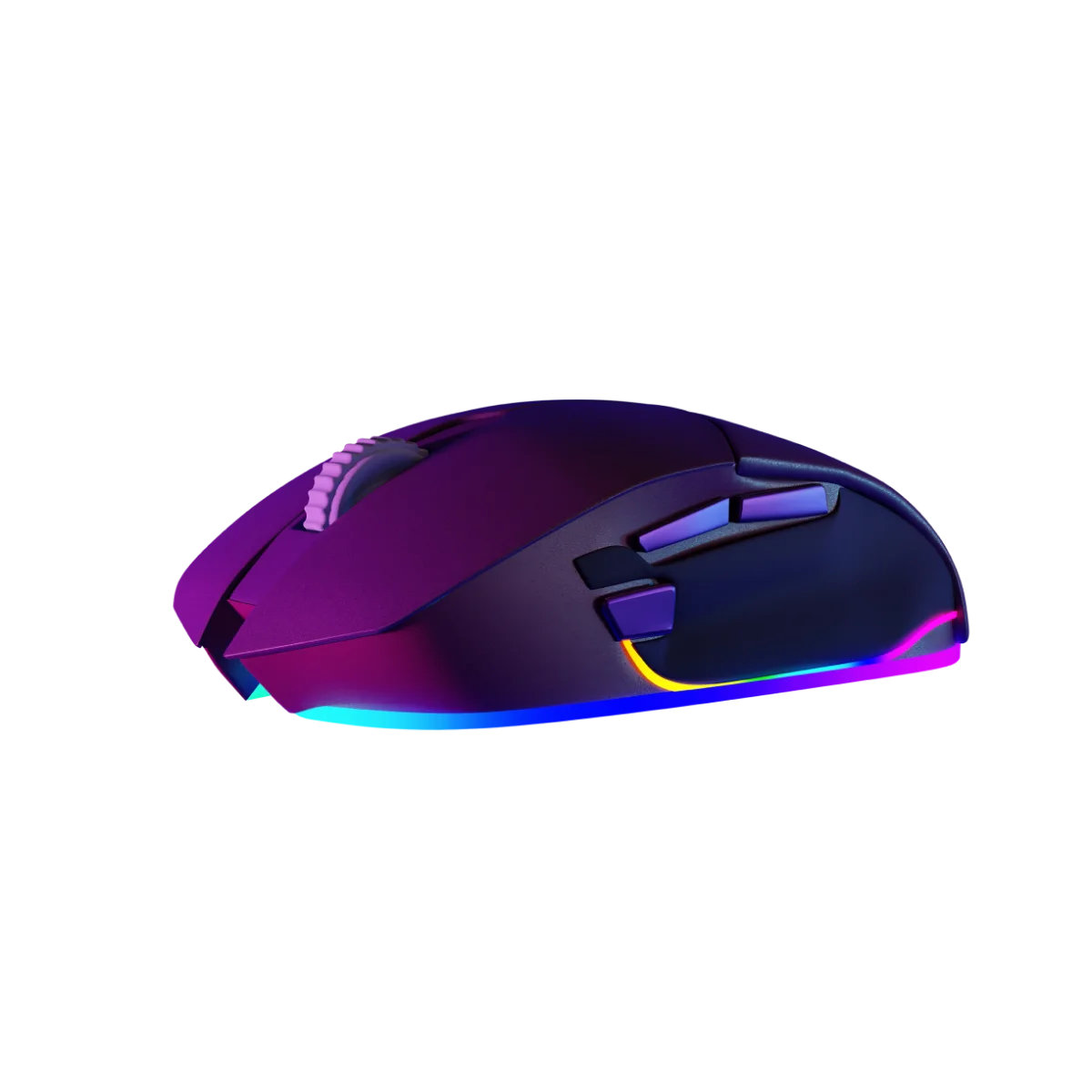

Victrola Wireless Music Edition 1 Bluetooth Speaker SVART

kr 350 inkl. MVAMå ha USB-C lader for å lade! (USB-C til USB-C kabel følger med). 12 timers batteritid. Metall-konstruksjon, Dual Speaker pairing, USB-C MP3 playback.

Les mer på produsentens side

-

DEJI universal solcelle Powerbank 10.000mAh (37 Wh) med 2 USB-utganger. Lommelykt /blinkefunksjon

kr 350 inkl. MVAVi har testet ved å starte med solcelle-powerbanken helt tømt for strøm for å se om hvordan den fungerer i nødstilfelle. Etter relativt kort tid i solen var det nok til å starte lading av mobiltelefon. Man kan klare å holde telefonen ladet kontinuerlig uten tilgang til strømnettet dersom nødvendig, avhengig av mobilbruk, solforhold osv.

Praktisk på lange turer, i båt, på stranden osv. for lading av mobiltelefoner osv. Kraftig lommelykt med SOS-blinke-funksjon. Enkel i bruk (NB! husk bare et raskt trykk på POWER-knappen for å sette i gang lading – et lengre trykk vil skru på lykt!).

Universal solcelle Powerbank 10.000mAh (37Wh). -

Origami smartdeksel for Amazon Kindle Paperwhite5 (6.8-tommer)

kr 160 inkl. MVAVeldig lett (bare 102 gram) og fleksibel beskyttelse fra Walkers for Amazon 5. generasjon Paperwhite (11. gen) med 6,8″ skjerm. Fronten kan i tillegg til å åpnes som en bok og bøyes bak, også brettes på forskjellige måter for å fungere som et stativ både liggende og stående:

Spesialtilbud

Apple iPhone

dager

timer

minutter

sekunder

Flere modeller

fra kr. ???,-

Siste produkter

...nylig lagt til i nettbutikken

-

Tuya smart nattlys. Google Home, Alexa RGB-CW LED med bevegelses-sensor

kr 390 inkl. MVAPlugges rett i stikkontakt. Kobles til Tuya/Smartlife. Kompatibel med Amazon Alexa/Google Home. RGB farger justerbar, eller hvit (varm-kald justerbar). Mål: 54x68x33mm+stikk.

-

Tuya Smart taklampe. Google Home, Alexa APP/fjernkontroll 24W LED 1920LM

kr 490 inkl. MVAWiFi og Bluetooth. Kan kobles til Tuya/Smartlife, men kan også bare benyttes med fjernkontrollen som følger med. Kompatibel med Amazon Alexa, Google Home, Tmall Genie, Yandex Alice. RGB farger justerbar (16M farger), eller hvit (varm eller kald justerbar 2700-6500K). Det står at kanten rundt er 1,8 cm, og det stemmer, men lampen er litt buet, så det er tykkere mot midten. Mål: 32cm diameter x 4cm tykkelse (midten, og ned mot 1,8 cm på kanten).

-

Tuya Smart Neon fleksibelt LED-bånd 5m. Google Home, Alexa APP/fjernkontroll mikrofon IP67

kr 590 inkl. MVAKan kobles til Tuya/Smartlife, men kan også bare benyttes med fjernkontrollen som følger med. Kompatibel med Amazon Alexa, Google Home, Tmall Genie. RGB farger justerbar (16M farger), eller hvit (varm eller kald justerbar).

-

Smartlyspære GU10 5W Tuya, Google Home, Alexa

kr 130 inkl. MVASokkel GU10. Kobles til Tuya/Smartlife. RGB farger justerbar (rød/gul/blå/grønn/lilla osv.), eller hvit (varm eller kald justerbar 2600-6500K).

-

Smartlyspære E27 Tuya

kr 110 – kr 128 inkl. MVAStandard stor sokkel E72. Alle kan kobles til Tuya/Smartlife, men har ellers forskjellige tilkoblingsmuligheter (velg). RGB farger justerbar (rød/gul/blå/grønn/lilla osv.), eller hvit (varm eller kald justerbar 2700-6500K).

-

Tuya smart røykvarsler WiFi

kr 290 inkl. MVABruker 2 stk. AAA batterier (IKKE inkludert). Kobles til WiFi (Tuya/Smartlife) i tillegg til vanlig lydvarsel (90db).

-

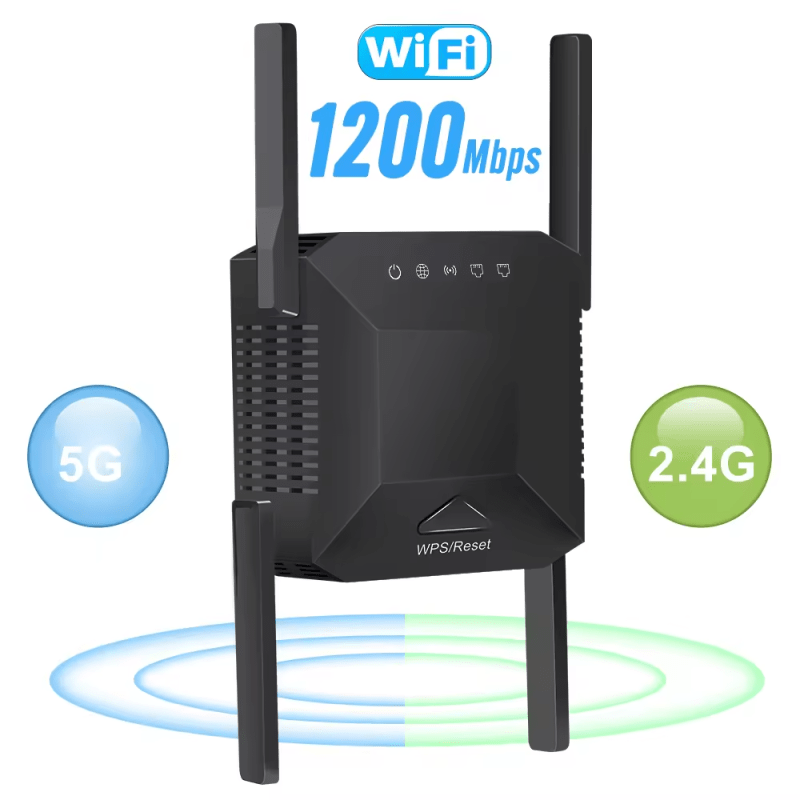

WiFi range extender/repeater 1200Mbps 2,4/5GHz

kr 450 inkl. MVAMed 4 antenner og strømplugg på baksiden (plugges rett i stikkontakt mellom router og der du vil forbedre dekning). Trenger ikke kabel. Også med LAN og WAN kontakter (dersom du ønsker å koble med kabel for å forbedre signal eller bruke den som aksesspunkt). Mål: 86*76*34mm.

-

Tuya Mini Video Doorbell (dag+IR-natt) videodørklokke oppladbar med 2 ringeklokker

kr 350 inkl. MVASvar på ringeklokken uansett hvor du måtte befinne deg fra smarttelefonen med HD dag og infrarød natt video og 2-veis lyd. Helt trådløs ringeklokke (lades med USB-C). Inkludert i esken: Doorbell , skruer, USB-A til USB-C ladekabel og 2 stk. mini ringeklokker (55x42x11mm+USB-A) for tilkobling til USB-A uttak (kjøp gjerne USB-ladere hvis du ikke har). Også mulighet for video-opptak (les mer lenger ned). Liten og kompakt: Høyde: 85mm, bredde: 53mm og dybde: 24mm (med festeplate). Mulighet for lagring i skyen (service kjøpes via Tuya – tar bilde når ringeklokken trykkes på). Smart Life (Tuya).

Føl lyden

lydprodukter

-

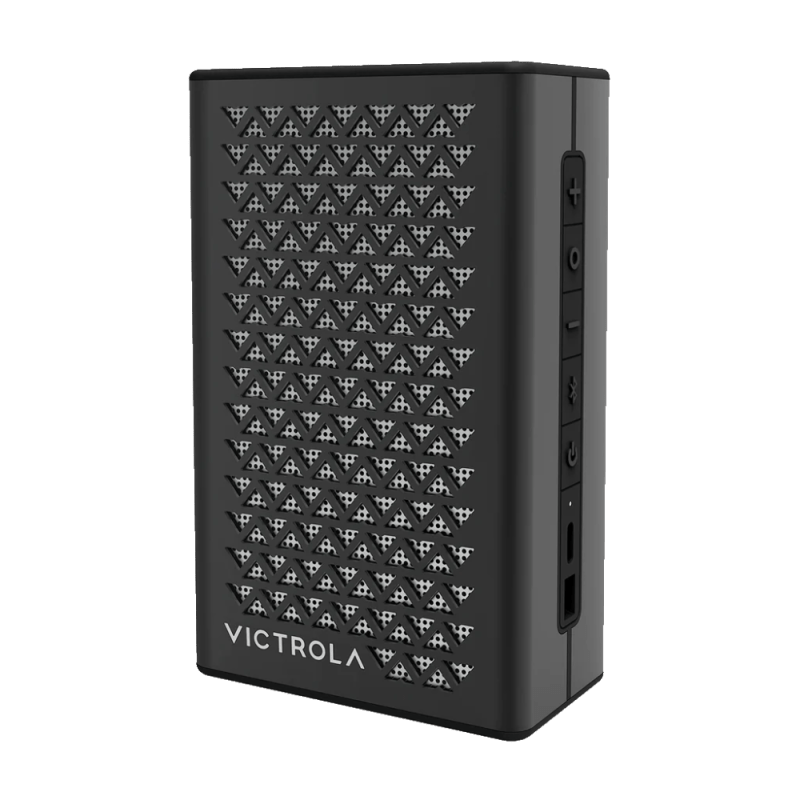

Victrola Wireless Music Edition 2 Tabletop Bluetooth Speaker m/innebygget trådløs ladeplate SØLV (alu.)

kr 1000 inkl. MVASolid og stilren metallutførelse. Kan brukes både ute og inne. Multi-speaker pairing tillater trådløs sammenkobling av to stykker. Legg mobilen på toppen for trådløs lading.

Les mer på produsentens side

-

Victrola Wireless Music Edition 1 Bluetooth Speaker SVART

kr 350 inkl. MVAMå ha USB-C lader for å lade! (USB-C til USB-C kabel følger med). 12 timers batteritid. Metall-konstruksjon, Dual Speaker pairing, USB-C MP3 playback.

Les mer på produsentens side

Hvorfor ontel?

Nye og brukte iPhone og andre produkter

Flere nyheter kommer her snart.

Vi holder på å oppdatere nettbutikken med flere produkter og en bedre handleopplevese

Om ontel.no

Vi byttet navn til ONTEL i 2022, men har holdt på i mange år og med samme firma siden 2016 da det ble endret selskapsform, men nettbutikken er mye eldre, og vi satser på faste kunder gjennom mange år.

Nyheter

Du kan nå velge hentested for pakker, velge flere betalingsmetoder både privat og til firma, og mange andre nyheter (både produkter og funksjoner) etterhvert i den nye nettbutikken.

Meld deg på vårt nyhetsbrev

Få opptil ??% avslag på ditt kjøp